Investeringen beoordelen: Economische benadering

IR, Interne rentabiliteit

IR, Interne rentabiliteit

Interne rentabiliteit

De interne rentabiliteit is een manier om de winstgevendheid van een investering uit te drukken die gebruik maakt van het begrip netto contante waarde. Het begrip wordt afgekort met IR. De interne rentabiliteit berekent de economische winst in de vorm van het verdisconteringspercentage waarbij het investeringsproject netto contante waarde gelijk aan #0# heeft.

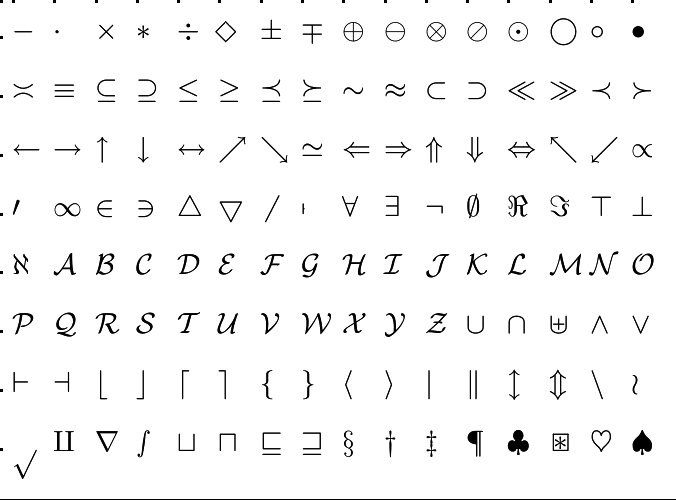

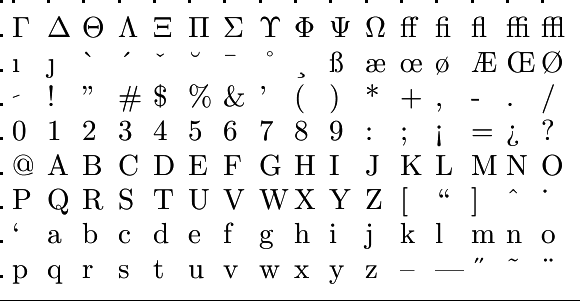

De methode om de interne rentabiliteit te berekenen is het oplossen van de vergelijking #NCW = 0# met de verdisconteringsvoet #r# als onbekende:

Interne rentabiliteitVoor een gegeven investering met looptijd #n# en geldstromen #C_0, C_1, \ldots, C_n# is de interne rentabiliteit gedefinieerd als het percentage dat bij de verdisconteringsvoet #r# hoort, waarvoor #NCW = 0#, dat wil zeggen: de netto contante waarde van de investering #NCW# is precies gelijk aan #0#. Met behulp van de formule voor de netto contante waarde is deze vergelijking te schrijven als

\[ \sum_{i=0}^{n} \dfrac{C_i}{(1+r)^i} = 0\]

Het grote voordeel van de interne rentabiliteit als beoordelingsmethode ten opzichte van de netto contante waarde is dat deze methode investeerders beter in staat stelt om meerdere investeringen met elkaar te vergelijken. Dit kan het beste toegelicht worden met behulp van een voorbeeld.

Vergelijken van investeringen

Stel dat we een keuze moeten maken tussen twee investeringen, investering #1# en investering #2#, die beiden een netto contante waarde hebben van #\euro\,1000#. Op het eerste gezicht lijken de twee investeringen even winstgevend en zou een investeerder beide opties even hoog moeten waarderen.

De kosten van investering #1# blijken echter in totaal #\euro\,10\,000# bedragen terwijl de kosten van investering #2# in totaal #\euro\,50\,000# zijn. Als we dit gegeven meenemen wordt het duidelijk dat investering #1# een veel betere optie is dan investering #2#, aangezien de investeerder een aanzienlijk kleiner bedrag op het spel hoeft te zetten om uiteindelijk dezelfde hoeveelheid winst te behalen. Oftewel, het risico van investering #1# is een stuk lager dan het risico van investering #2#.

Doordat de netto contante waarde de winstgevendheid van een investering uitdrukt in een absoluut getal is deze methode vaak ongeschikt om meerdere investeringen met elkaar te vergelijken. In tegenstelling tot de netto contante waarde, drukt de interne rentabiliteit de winstgevendheid van een investering uit in een percentage waarbij er rekening gehouden wordt met de verhouding tussen de kosten en opbrengsten van een investering. In het bovenstaande scenario zal investering #1# dus een hogere interne rentabiliteit hebben dan investering #2#.

\[\begin{array}{l|c} &\text{Geldstromen}\\ \hline\ C_0 & -495\\\ C_1 & 115 \\ \ C_2 & 115 \\ \ C_3 & 115 \\ \ C_4 & 115 \\ \ C_5 & 115 \\ \end{array}\]

Bepaal de interne rentabiliteit van de investering.

De interne rentabiliteit is gedefinieerd als de waarde voor de verdisconteringsvoet #r# waardoor de netto contante waarde van de investering gelijk is aan nul. Om de interne rentabiliteit te bereken moet dus de volgende vergelijking voor #r# opgelost worden:

\[NCW = -495 + {{115}\over{1+r}}+{{115}\over{\left(1+r\right)^2}}+{{115}\over{\left(1+r\right)^3}}+{{115}\over{\left(1+r\right)^4}}+{{115}\over{\left(1+r\right)^5}}=0\]

- Invullen van #r = 0.05\,# geeft #\,NCW = # #3#.

- Invullen van #r = 0.06\,# geeft #\,NCW = # #-11#.

omptest.org als je een OMPT examen moet maken.